Why subscribe to HF&G?

Huat Fearful & Greedy will help subscribers unearth profitable investment ideas with a focus on two key areas:

1) Asian Yield Plays: in a low-interest world we uncover solid Asian dividend investments

2) Asian Small & Mid Caps: we uncover some of the most compelling Asian small & mid-cap ideas

Asian equity markets have underperformed Western stock markets between 2010-2019 (source: Business Times).

Early in 2020 we are again witnessing the upward “explosion” of stocks such as Tesla, Beyond Meat and SmileDirectClub. None of them make any money on a GAAP basis, and none generate actual operational cash flow, yet all these stocks trade at stratospheric valuations.

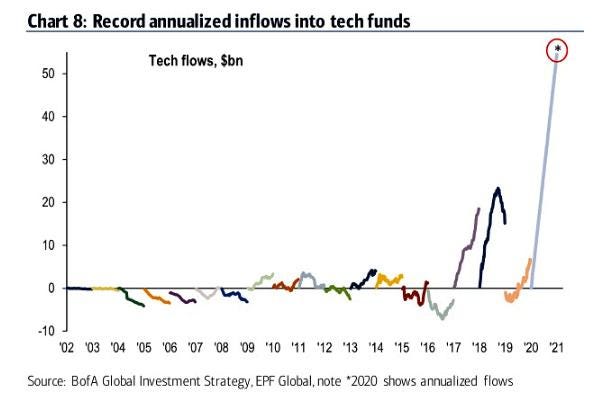

Global investors are equally in love with tech “powerhouses” such as Amazon, Apple and Google which all support valuations in the trillions of dollars. In 2020 tech funds have seen record inflows (source: BAML). What the wise do in the beginning, fools do in the end?

Investors are currently in love with US technology stocks but have neglected small-caps globally and particularly in Asia. Our premise is that the coming decade, from 2020 to 2030, will look much different versus the past decade as US equity valuations start from a high-base (Greedy) while Asian valuations start from a low base (Fearful).

The below chart (source: Goldman Sachs per 31/12/19) highlights two additional points:

Chart 1 shows one of Warren Buffett’s favourite metrics in determining if markets are cheap or expensive. It measures the US overall market cap (this means the valuation of all companies listed on US exchanges) compared to the GDP of the United States. We have now exceeded the peak in 2000 at just over 200%.

Chart 2 shows that the Energy sector weighting in the S&P 500 is at its lowest level in the last thirty years. The market is truly a pendulum and things that are loved (greedy) become unloved (fearful) and vice versa. As an example: we will look at opportunities in the Asian energy segment for both yield and value opportunities.

HF&G is not alone in its thinking. Huat?

Yes, there are plenty of smart investors who broadly share our views….two examples

The Big Short

During the Global Financial Crisis a few smart investors recognized the US housing crisis beforehand and made great returns for their investors while global equity markets corrected sharply in 2008. One of those investors was Michael Burry, who has been featured in the Hollywood film The Big Short (note: you can watch it on Netflix).

In the middle of 2019 journalists contacted Michael Burry to hear his outlook on investment opportunities today. Michael Burry believes there is a bubble in passive investing. This means money flowing to indexes and being invested in all the biggest companies in the world without much thought about their valuations. This trend has been going for years with the explosion in ETF (Exchange Traded Funds). The trend has pushed large US companies such as Apple, Amazon, Google and Facebook to stratospheric valuations.

His quote:

The bubble in passive investing through ETFs and index funds as well as the trend to very large size asset managers has orphaned smaller value-type securities globally.

There is all this opportunity, but so few active managers looking to take advantage

Jeremy Grantham- GMO

Over the past decades there are very few investors who have correctly called the Japanese equity bubble in the 1980’s, the Tech bubble in 2000 and avoided the housing crash in 2008. One of them is Jeremy Grantham of GMO. On the 3rd of December 2018 he said the following about Emerging Markets forecasts (source: Barron’s):

So one would think you should be lightening up on US stocks here and buying Emerging Market (EM) value?

Well, that would be a very conservative statement. I think what you should do here is sell all of your US stocks, there has never been a bigger valuation gap between the US and emerging than there is now. And those opportunities don’t come very often and they have a very old-fashioned feel to them and I described it basically as you buy when they are very cheap, they become extraordinarily cheap, you suffer, you double down, maybe suffer a bit more, and then you win. And if you can take the pain, you always win on those kind of bets. There is very little chance that you’ll come back in 10 years and EM will not have beaten the pants off the US.

Grantham’s firm GMO has been making 7-year forecasts for equity returns and those are currently (as per 23/11/19) showing the following: the only positive returns that are expected are in emerging markets (dominated by Asia) and even more so in emerging value. Given that market capitalizations in Asia are mostly smaller than those in the US/EU we agree there is a treasure trove of ideas waiting to be uncovered. HF&G will help its subscribers find these opportunities.

Subscribe to get full access to the HF&G newsletter and website. Never miss an update and start making profitable investments now.

About the Author

Nicolas Van Broekhoven grew-up in Belgium, was educated in the US (Bentley University) and has been a permanent resident in Singapore since 2013. Nic was active as an analyst and portfolio manager in the asset management industry working in Luxembourg, Belgium and Singapore between 2003-2016. Most of this time was spent at a mid-sized boutique asset management firm (Value Square) where he continues to be a member of its advisory board.

He started writing for Smartkarma in early 2017 with a key focus on unearthing small-cap stocks across Asia. Nic has been consistently ranked on the top quartile of contributors in the Smartkarma platform.

Between 2017 and early 2020 he has uncovered and publicly written about several highly successful Asian small-and mid cap investment ideas, such as:

Advised to buy Micro Mechanics (MMH SP) at 0.96 SGD in February 2017. Currently, MMH has almost doubled to 1.9 SGD, a total return including dividends over 113%.

Recommended China Meidong (1268 HK) at 1.55 HKD in May 2017. Currently, Meidong is trading around 10.20 HKD, a total return over 600% including dividends.

Warned readers to avoid/short MY EG Services (MYEG MK) at 2.16 MYR in June 2017. Currently, MY EG Services is trading at less than 1 MYR.

Advised to buy Frencken (FRKN SP) in October 2017 at 0.55. Currently, Frencken is trading at 0.90 SGD, a total return including dividends over 73%.

Followed the continuing saga around Procurri (PROC SP) with multiple insights recommending to buy the counter between 0.18-0.30 SGD. Currently, shares are around 0.33 SGD having peaked at 0.49 SGD in late 2019.

Advised readers to stay invested in AEM Holdings (AEM SP) non-stop since December 2017. Shares have gained over 145% since my initial recommendation, despite incredible volatility and occasional sell-side skepticism.

Warned readers to be wary of Indonesian billionaires listing their stocks outside of Jakarta as they have mostly produced disastrous returns for shareholders.

Nic’s insights have been quoted in The Straits Times, Business Times, Bloomberg, Forbes Asia, TechInAsia, The Wall Street Transcript, Better Investing Magazine and MoneyFM. He has spoken at multiple SGX and ShareInvestor events. In the past he was also regularly quoted in some of Belgium’s largest newspapers such as De Tijd or De Standaard.

Stay up-to-date

You won’t have to worry about missing anything. Every new edition of the newsletter goes directly to your inbox.

You will receive at least 12 actionable investment ideas per year + any additional commentary if important news happens.

Join the crew

Be part of a community of people who share your interests.