HF&G: ISSUE 1 - FEBRUARY 2020 - YIELD MACHINE TO SOOTH YOUR PAIN

In our inaugural issue of HF&G, we will get started with one yield idea (it has gone up 1,061% since 2000), has a market cap over 2 billion USD but has zero analyst coverage!

In their quest for regular dividend paying stocks the tendency of many investors is to look at those stocks with incredibly high yields. The lure of high dividend paying stocks can be warranted but can also lead to unattractive outcomes. It is one thing to collect a very high dividend, but if the underlying share price corrects sharply all the dividends in the world will not compensate the capital loss.

Case in point would be Asian Pay TV (APTT SP) (chart source: Refinitiv):

APTT, which we have previously written positively about on Smartkarma in 2017, had its IPO in 2013 at 0.90 SGD with an indicative yield over 8%. This was a yield premium of 20-30% over most S-Reits or Singapore listed business trusts at the time. As one can see in the chart above it has been an absolute train-wreck as the underlying business in Taiwan has been in a steady decline and gearing was too high.

Currently, APTT is in a “strategic review” and our bet is it will eventually be privatized by a Taiwanese strategic telecom player. With the shares currently around 0.165 SGD there could potentially be upside to around 0.20 SGD in any buyout scenario. However, APTT is NOT our recommendation as a yield play. We are merely using APTT as an example to pre-face our recommendation for our first yield-stock Singapore listed Haw-Par (HPAR SP).

Haw Par is NOT a high dividend payer but a very consistent one making this the ideal candidate for our Yield Ideas portfolio.

Haw Par

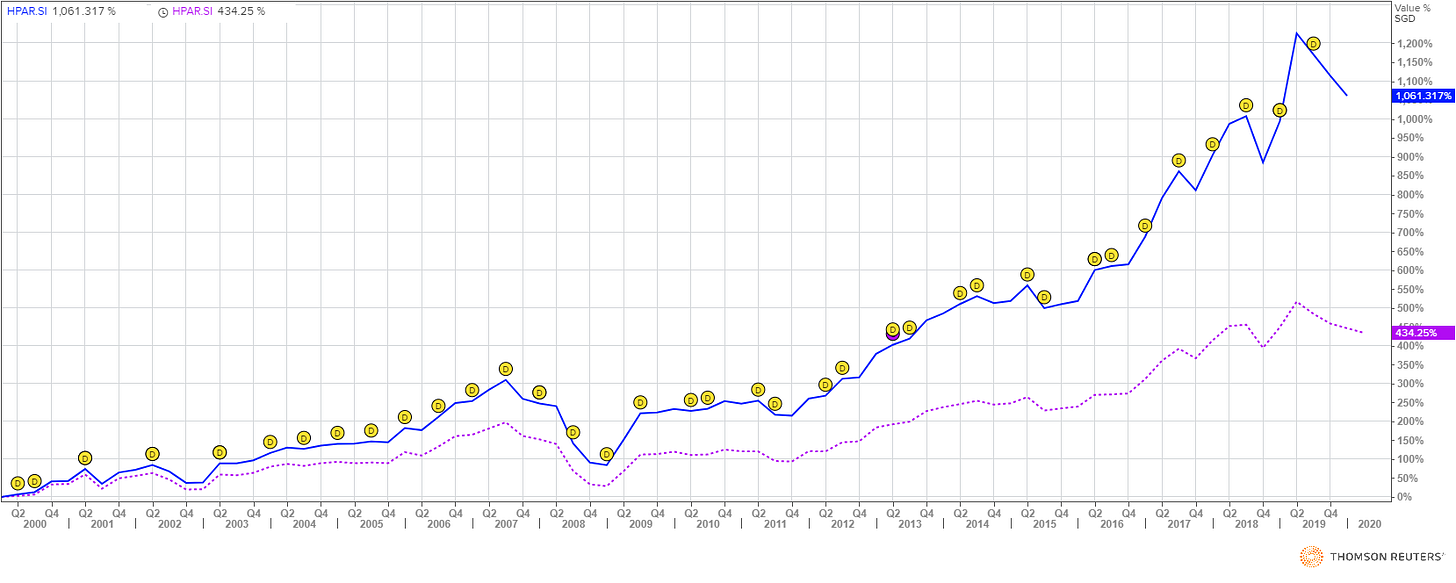

Haw-Par has been listed on the SGX (Singapore Exchange) since 1969. Ever since its listing it has been a consistent dividend payer. Below we include its chart since 2000 (source: Refinitiv). During this period it was at a low of 1.68 SGD in June 2000 and an all-time high of 14.86 SGD in May 2019. The yellow dots on the chart indicate all the dividend payments investors would have received.

The above chart also demonstrates the enormous power of regular and special dividends. The total return including dividends has been 1,061% since 2000 versus the stock price return of “just” 435.25% over this time.

The performance of Haw Par has been stellar since its IPO in 1969 and our bet is it will continue going forward driven by its generous dividend policy of returning 40-50% of net income to shareholders.

The Family Holding

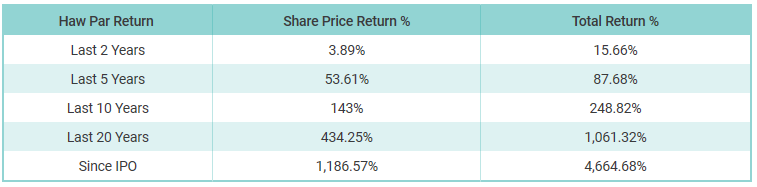

Haw Par is a legendary name in Singapore. Below is its history (source: hawpar.com). We could have summarized it briefly but encourage all subscribers to read the entire story to appreciate the company’s heritage.

Legend from a Jar - The Story of Haw Par

Our story goes back to the 19th century. The history of the legendary brothers Haw (胡文虎) and Par (胡文豹) and the origins of their genius traced back to Rangoon (Yangon), Burma (Myanmar), where it all began. Their father, Aw Chu Kin (胡子钦), the young son of a herbalist in Xiamen, Fujian Province, left for Rangoon in the 1800s to seek his fortune. In Rangoon, he set up his own physician practice and apothecary shop and founded Eng Aun Tong, or the Hall of Everlasting Peace, and started a family.

Boon Haw named his product Tiger Balm – the embodiment of strength and vitality in the East.

Boon Haw, the "gentle tiger" and Boon Par, the "gentle leopard"

Boon Haw, the "gentle tiger", born in 1882, was educated in China, and Boon Par, the "gentle" leopard", born in 1888, studied in an English language school in British colonial Burma.

In 1908, Chu Kin died, leaving the family practice to Boon Par. The gentle leopard, finding the responsibility too much to bear, later asked for his older brother's return from China to carry on the family business in Rangoon.

"I will learn all I can about Western medicine, you can prescribe Chinese medicine. Together we won't lose a single patient. He can choose between east and west and the fee will stay with us," Boon Par said to Boon Haw.

Origins of the Tiger Balm formula

The origins of that formula can be traced back to the times of the Chinese emperors who sought relief for aches and pains from the stresses of court hearings. The balm would have died with the dynasties had it not been for Aw Chu Kin, who breathed new life into the ancient recipe.

To perfect their late father's recipe, the sons took over their mother's kitchen. Boon Par, the quiet leopard, toiled whilst Boon Haw, the gregarious tiger, organised. Together they produced “Ban Kim Ewe”, Ten Thousand Golden Oils, a panacea for all ills. No customer left the Aw apothecary without a little bottle of this golden ointment. True to the Tiger's predatory instincts, Boon Haw sought out every Chinese shop in town and talked them into stocking his salve.

The first Eng Aun Tong factory at Neil Road in Singapore in 1926 (top) and the Tiger Balm factory at Chia Ping Road in 1969 (bottom)

Boon Haw ventured south to Malaya and Singapore

Boon Haw's next logical step was a trademark: what else but his own name, and Tiger Balm was born. By 1920 Aw Boon Haw, not yet 40, was the richest Chinese in Rangoon. Ever the risk taker, Boon Haw ventured south to Malaya and Singapore. The sights and sounds of bustling commerce in the Malayan towns and Singapore's port made his heart beat fast and his head race. Studying the Singapore currency he saw the image of a snarling tiger in the watermark. That clinched it.

The Tiger tycoon moved into Singapore in 1926 and Eng Aun Tong found a spanking new home in the busiest port in the region. A new and larger factory was built along Neil Road where production was ten times more than that of Rangoon. Aw Boon Haw plied small towns in Malaya in his custom-made car which had a head fabricated like a tiger and a honk that roared. When the kampong folks crowded around, he would distribute samples of Tiger Balm and its sister products and win still more customers.

Haw Par Villa built by Boon Haw for his brother Boon Par (left) and his custom-built tiger car (right)

Haw Par Brothers International Limited listed on the stock exchanges of Singapore and Malaya

A new mansion, Haw Par Villa, was built on a hill in Pasir Panjang surrounded by unique gardens depicting Chinese mythology for the younger, quieter Boon Par in 1937. Also known as Tiger Balm Gardens, it was open to the public.

With factories and distributorships firmly established in Malaya, Hong Kong, Batavia (Jakarta), cities in China and Thailand, and with wealth and status long achieved, Boon Haw next channelled his energy into diversification, which would include publishing and banking.

Boon Par died in Burma in 1944 while Boon Haw died in 1954 at the age of 72 from a heart attack on his way to Hong Kong following a major operation in Boston. Boon Par's son, Aw Cheng Chye, assumed control of the family business. In 1969, most of the family businesses went into a company that was listed on the stock exchanges of Singapore and Malaya as Haw Par Brothers International Limited. In 1988, the Singapore Tourism Board took over the running of the Tiger Balm Gardens and renamed it Haw Par Villa. Haw Par Brothers International Limited was later renamed Haw Par Corporation Limited in 1997.

Tiger Balm is sold in 100 countries with fans from all over the world.

Eager to expand his business empire, Aw Cheng Chye invited British investment group Slater Walker Securities Limited to take a stake in Haw Par. On 8th June 1971, Slater Walker took control of Haw Par. During the “Slater Walker” period (1971 - 1976), Tiger Balm and Kwan Loong, both brands owned by Haw Par, were franchised for 20 years to Jack Chia Group. Massive irregularities and personal interests were involved during this period and the empire came to a spectacular collapse. Michael Fam was brought in by the government to steer the company back to its feet as its Chief Executive (1975 - 1977). There followed a period of uncertainty as three corporate heavyweights battled for the control of Haw Par: Hong Leong Group, Jack Chia Limited, and United Overseas Bank (UOB) headed by Wee Cho Yaw. On 3rd June 1981, UOB emerged victorious and in 1992, Haw Par took back Tiger Balm and Kwan Loong from Jack Chia after the expiry of the 20-year licence. Under the prudent stewardship of Chairman Wee Cho Yaw, Haw Par grew steadily in assets as it sharpened its focus and divested itself of most under-performing and non-core businesses.

Today, we are no longer the diversified conglomerate that we were in the 1970’s and 80’s, but a company with strategic investments, investment properties, and two operating businesses, Healthcare and Leisure that promote healthy lifestyles through our offerings.

As one of the leading companies listed on the Singapore Exchange, Haw Par continues to expand its product extensions with businesses spanning the globe. The legend of Haw Par lives on.

Haw Par in 2020:

Tiger Balm, Property and a Bank

The crown jewel of Haw Par is undoubtedly Tiger Balm. As already explained in the brief history section above the value of the brand is high and growth has been phenomenally over the past 15 years. Haw Par only started to breakout Tiger Balm (referred to as Healthcare division in annual report) as a separate category in its financial statements since 2000.

Historically Tiger Balm was centered on two products: one red color and one white color. The ointment was extremely greasy and left stains on clothes yet had many followers.

Over the years, the current management has innovated and expanded its product range substantially adding more user-friendly creams, sprays, patches, muscle rubs and plasters. We personally are big fans of the mosquito patches but have also used their other products occasionally.

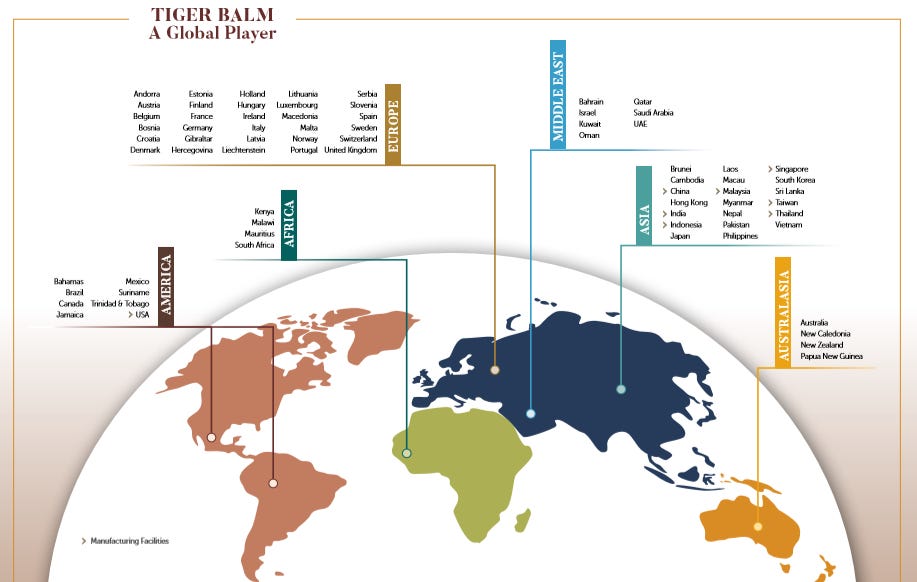

Tiger Balm today is a global product with a presence in at least 140 countries and over 50 million units sold per year. In 2018 46.5% of sales were generated in ASEAN, 33.7% in the rest of Asia and the remaining 19.8% in the rest of the world. The company has manufacturing facilities in Malaysia, Singapore, USA, China, Taiwan, Thailand, India and Indonesia. Haw Par should therefore be able to weather any supply disruptions (see recent Corona Virus outbreak) or trade wars very effectively.

Tiger Balm Growth is Accelerating

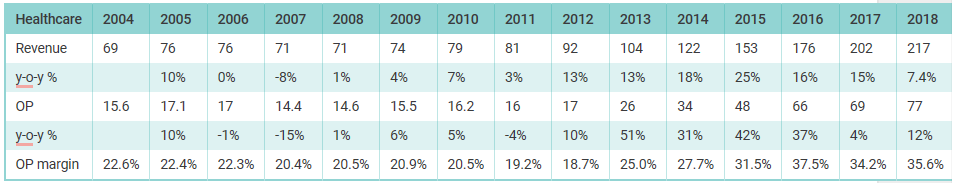

Tiger Balm’s growth is gaining traction and has had a CAGR of 9% revenue growth between 2004-2018 but 18% between 2011-2018. Operating profit CAGR has been even more remarkable at 13% between 2004-2018 but over 31% between 2011-2018. Operating margin has expanded from 22.6% in 2004 to 35.6% in 2018, or 1300bps of margin expansion in the last 14 years. We find that pretty impressive!

The growth of Tiger balm has accelerated not just in new markets but also in its core ASEAN market (+23% in 2018). Management measures itself by Return on Assets Employed and for the healthcare division this was a whopping 65.4% in 2018 vs 60.3% in 2017.

Drilling deeper into the financials we see that growing its healthcare business has occurred without high capital intensity (negative working capital) and fixed assets below 100 million SGD.

The moat of Tiger Balm is large as there is no clear competitor and its strength lies in its heritage and “top of mind” appeal. Across Asia when your shoulder or knee hurts the instinctive thought is: “let’s get some tiger balm”. When we think ketchup we say Heinz, when we want tissue paper we think Kleenex, when we think “cool motorcycles” we think Harley Davidson. Tiger Balm is in this category of brand recognition and has much further to grow.

The company has been using sports advertising across its markets globally.

Investment Portfolio: Property and a Bank

As Tiger Balm makes up 91% of Haw Par’s annual sales we will briefly discuss its key investment portfolio.

The key value of its investment portfolio lies in two listed entities: United Overseas Bank (UOB) and United Overseas Land (UOL). As these are very widely covered companies we will have no separate discussion on their investment merits.

UOB: Singapore’s third largest bank (43 billion SGD market cap). Haw Par owns 74.85 million shares which is 4.5% of shares outstanding. UOB currently trades at a P/E multiple of 10.3x and offers a 4.1% dividend yield. Over the past 20 years shares have appreciated by 151.92% and by 463.62% if all dividends were re-invested. UOB survived the 2008 GFC without the need to issue equity which shows a certain level of conservatism (or luck!).

UOL: Singapore property group (6.9 billion SGD market cap). Haw Par owns 72.05 million shares which is 8.5% of shares outstanding. UOL currently trades at a P/E multiple of 14.3x and offers a 2.1% dividend yield. Over the past 20 years shares have appreciated by 571.79% and by 1,418.54% if all dividends were re-invested.

Outside of its stake in UOL, Haw Par also owns a four properties directly: Haw Par Centre & Haw Par Glass Tower, Menara Haw Par and Haw Par Technocentre.

Haw Par Centre and Haw Par Glass Tower

Haw Par Centre and Haw Par Glass Tower are two adjacent office buildings located in Clemenceau Avenue, very close to Orchard Road.

Menara Haw Par

Menara Haw Par, a freehold commercial building in Kuala Lumpur, is located in the Golden Triangle along Jalan Sultan Ismail.

Haw Par Technocentre

Haw Par Technocentre is a light industrial building located in convenient and quaint Commonwealth Drive.

Occupancy across its portfolio has been solid over the last few years

Finally, it has an underwater park in Pattaya (Thailand) which we will not go into as its financials are a rounding error.

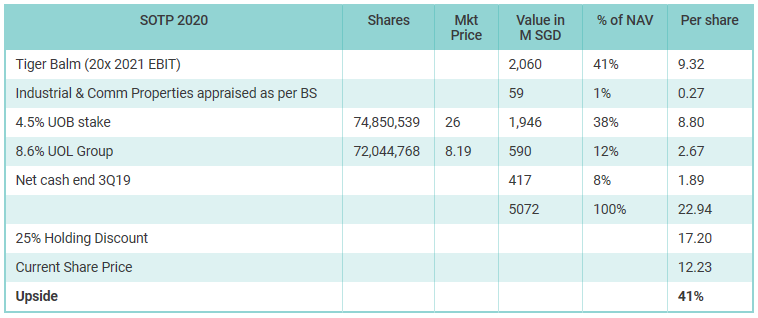

SOTP: Sum of the Parts

In order to value Haw Par we should look at its SOTP.

The key question in a SOTP of Haw Par is: what is the value of Tiger Balm? As the company is not listed on an exchange we can only make educated guesses.

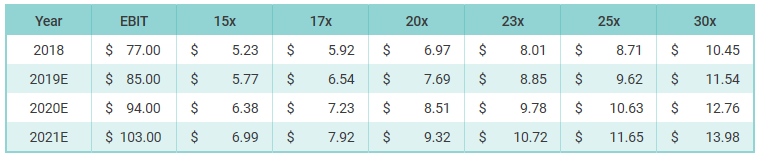

In our opinion the company should trade at least at 20x EBIT and if it were a standalone business with the growth between 2011-2018 as a benchmark it could easily trade at 30x EBIT. Every investor should however chose the multiple they are comfortable with valuing Tiger Balm.

In our SOTP we value Tiger at 9.32 SGD/share (20x 2021 EBIT est). Please note: 2019, 2020 and 2021 are our estimates as the company is yet to report its FY19 financials. It assumes an annual +/-10% growth in EBIT in all three years.

For the rest of the SOTP we value 1) its directly held property at its latest accounting value; 2) UOB and UOL at their latest stock price and 3) cash at fair value.

SOTP Analysis

From the above SOTP we can make the following observations:

If we add up just the value of its own property + stake in UOB + stake in UOL + Net Cash we arrive at a fair value of 13.63 SGD. This is a premium of 11% over the current share price.

The market is currently valuing Haw Par BELOW the value of its investment portfolio and with 0 SGD value awarded to its crown jewel Tiger Balm which generates 91% of its annual sales, has a EBIT CAGR of 31% the last seven years and OP margins over 35%. We think this makes no sense.

We arrive at a SOTP of 22.94 SGD including Tiger Balm, which offers 88% upside from its current 12.20 SGD level. If we assume a 25% holding discount the fair value is 17.20 SGD or 41% upside (excluding dividends).

Haw Par has consistently paid dividends for decades and we expect this will continue. Here is just its track record of DPS (Dividend Per Share) from 1999 to 2018. Typically dividends at Haw Par are paid in two installments (interim and final). Please note the very large “special dividend” in 2018 to celebrate its 50th anniversary.

Management & Key Shareholders

Haw Par is controlled by the Wee family and its founder Wee Cho Yaw. He was born in 1929 and in January this year just celebrated his 91st birthday. The Wee family is among the top-10 richest families in Singapore and he has a personal net wealth of an estimated 6 billion USD. The Wee family controls 27.55% of Haw Par. UOB has a cross holding of 9.81% in Haw Par. Actual free float is 40%.

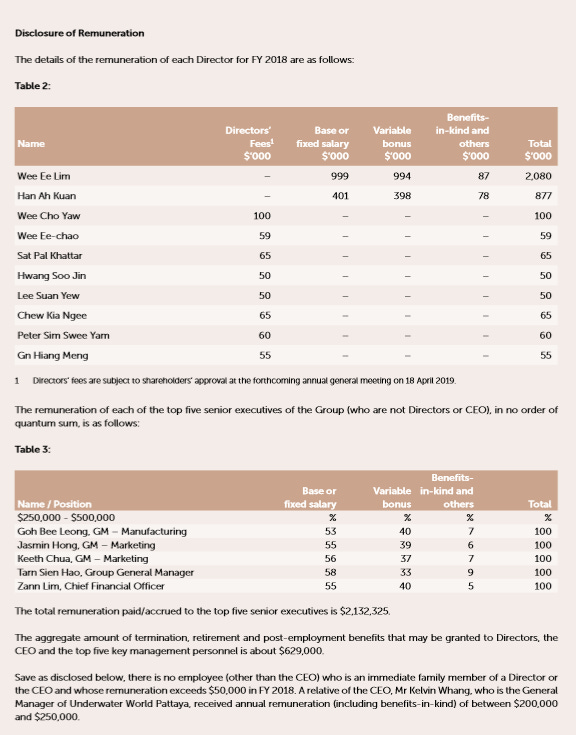

Outside of family members the company has professional management team which remuneration does not seem excessive as per its 2018 annual report disclosure. The group general manager has been in his role since 2001. Management does typically not attend conferences or other sell-side briefings.

Management has Long Term Incentive plan (page 41 annual report 2018) which prioritizes operating metrics such as profitability, return on assets and two year rolling targets.

Free float is 40% with First Eagle Investment Management owning over 11.4% and London based IVA owning close to 3%.

Key Risks and Catalysts

No investment is without risk and despite its stellar two, five, ten and twenty year track record Haw Par might just hit a rough patch and underperform or make bad capital allocation decisions. History suggests the board is prudent and shareholder friendly but it cannot be ruled out that management spends its cash on the wrong acquisition target. We do feel risks to the dividend are low as its dividend track record speaks loud and clear.

Another key risk is a severe downturn in the Singapore banking and property market which would drastically decrease the value of its holdings in UOB and UOL. Both survived the 2008 GFC intact but there is no assurance they could repeat that in any future crisis.

One risk (but it could also be a catalyst!) is the eventual death of its founder and long time Chairman Wee Chu Yaw. Having just celebrated his 91st birthday, the days ahead of him are surely shorter than the days he has already lived. To be clear, we are not hoping for Wee Chu Yaw to pass away, we are just pointing out human mortality is a given.

Haw Par has never publicly floated the idea to list Tiger Balm as a separate entity but a change of the guard might view this opportunity differently. We could imagine a scenario where the stakes in UOB and UOL get handed out in-specie to its shareholders and only Tiger Balm remains the key asset of Haw Par. Should such a scenario eventuate we think Haw Par would become a must-own asset for multiple consumer funds globally and be awarded a very-high multiple of EBIT (20x to 30x does not seem unreasonable). Given the history of Tiger Balm, and how hard the Wee family had to fight to gain control of the asset, we see no scenario where the brand ever gets sold.

Conclusion

In our first issue we hope to have demonstrated the kind of analysis you can expect from HF&G going forward. For some readers this piece might have been too long, for others it will be too short. We will strive to find a balance in length, level of detail and concrete idea generation. We will again summarize why we think Haw Par deserves your attention:

Haw Par has been listed since 1969 and a consistent dividend payer.

Haw Par’s track record in shareholder value creation is excellent over past two decades.

Haw Par is cheap on a SOTP basis; investors are either paying for the investment portfolio (and getting Tiger Balm for FREE) or they are paying for Tiger Balm (and getting the investment portfolio as a FREE bonus). Neither makes sense to us.

Assuming Haw Par trades at a 25% discount to its SOTP there is 41% upside to 17.30 SGD. Haw Par currently trades around 12.20 SGD which is below its peak of 14.68 SGD reached in May 2019. We would accumulate on weakness.

We like Haw Par for its dividend, not because it has the highest yield available, but for its continuity in paying attractive dividends to shareholders.

Haw Par pays dividends two times per year. These dividends are not taxed in Singapore but might be taxed in other jurisdictions.

Haw Par has a market cap of 2.7 billion SGD (2 billion USD) and ADTV of 778K SGD. Haw Par has no sell-side analyst coverage.

Final Note: as we are continuously looking to improve HF&G please let us know your thoughts or suggestions in the comment section OR email us at contact@huat.co

Last month we wrote about Haw Par, an underappreciated gem on SGX.

Since then markets have corrected sharply across the globe. Haw Par was not spared and declined by approximately 15%.

Over the past two weeks, its main shareholder (Wee family) has bought back 13.5M SGD worth of shares. He has been in the market consistently scooping up shares on a daily basis. We like to see insider buying from management as it signals their continued support.