HF&G Case Study 2017: China Meidong (1268 HK)

In May 2017 Smartkarma published our initial research on China Meidong when the stock was 1.55 HKD. Recently, shares are trading around 9.5 HKD, or a gain over 550%! See excerpts below:

China Meidong (1268 HK): MIT Graduate Leading Car Distributor to Success in China’s Tier 3/4 Cities

Published on Wed, 24 May 2017 10:22 by Nicolas Van Broekhoven

Executive Summary

China Meidong is a car distributor in China's Tier 3/4 cities with 34 stores at end of 2016

What started with distribution of Toyota/Lexus has evolved into focus on Porsche and BMW

Company still trading below IPO price of 1.8 HKD (listed on HKex since December 2013)

New BMW 5-series launch and store expansion should produce strong 2017 results

Management led by MIT graduate Ye Tao and his brother Ye Fan, who jointly own 69% of company

Shares trading at 6.75x 2017 P/E and offer 5.8% dividend yield

Fair Value: 1.9 HKD (bear case) 24% upside; 2.53 HKD (base case) 65% upside; 3.17 HKD (bull case) 107% upside

Detail

On a recent trip to China and HK, I had time to sit down with the management of China Meidong Auto Holdings (1268 HK). The stock has been written about multiple times on SmartKarma in 2015/2016 but the last article is over 9 months old. Time for an update.

The reason for my interest in China Meidong was my hunt for car distributors that would benefit from the launch of the new BMW 5 series (see picture below) and were still trading at cheap multiples. While the car is already launched in Europe it's official debut in China is planned for July.

Car dealers are heavily dependent on the product cycles of the brands they sell. Mercedes just had a few strong years with the launch of several new cars. BMW's product cycle is now looking interesting with some new launches in the offing.

Historically the BMW 3- and 5-series are the most important launches for BMW and should drive volumes to the car dealers focused on BMW. Meidong's BMW sales mix is as follows: +/- 25% of volumes is linked to 5-series (incl X5) and +/- 25% to 3-series (incl X3). The 3-series will be renewed in 2018/2019.

BMW will be renewing its most important models in the next 36 months which bodes well for Meidong.

China Meidong is clearly not the only listed car dealer in China. In fact it is one of the smallest by market valuation.

The main competitors of Meidong are Zhongsheng Group Holdings (881 HK), China Zhengtong Auto Services Hldg Ltd (1728 HK), China Yongda Automobile Services Hldg (3669 HK), China Harmony New Energy Auto Hlding Ltd (3836 HK), Baoxin Auto Group Ltd (1293 HK), Sunfonda Group Holdings Ltd (1771 HK) and China Greenland Rundong Auto Group Ltd (1365 HK).

Note: Investors should definitely read the great insight China Auto Sector – Bearish on Car Loan Growth by Scott Laprise/ 乐天虎 on why investing in the car sector in China is not without risk!

For more background on China Meidong please read the write-ups by Sameer Taneja which are listed in the insight stream.

China Meidong was listed 5th of December 2013 at 1.8 HKD per share. Currently the shares are below 1.55 HKD and, if you were to include dividends (0.14 HKD) since IPO, shareholders would still have not broken even on their IPO investment. Not very exciting given the car market has been booming in China for years. Why consider Meidong now?

2017 could be a year where very strong results and store network expansion lead to a combination of fast profit growth and a potential re-rating. In its 2016 annual report the management refers to 2017 as the inflection point.

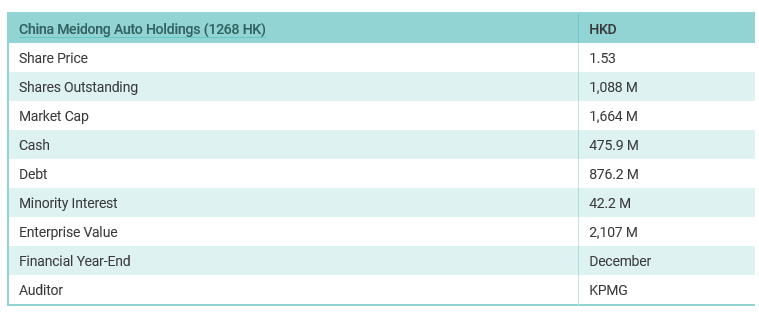

China Meidong Auto Holdings (1268 HK)

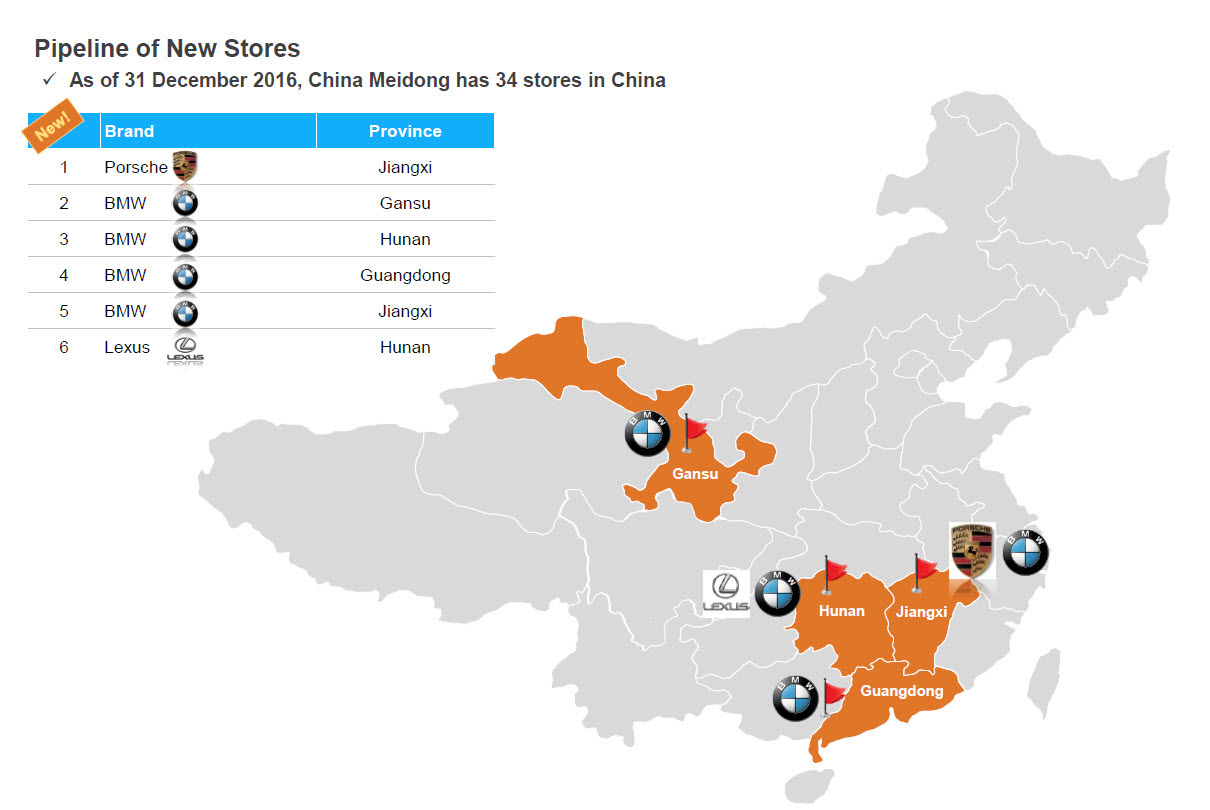

Currently Meidong has 34 stores in following Chinese provinces: Guangdong, Fujian, Jiangxi, Hunan, Hubei, Gansu, Hebei and Beijing. During 2017 it will open another 7 stores (+26% store count growth). In 2018, it should open another 5. Meidong currently has 2,825 employees and this number will grow as the group expands.

The overall Chinese car dealer market is getting more saturated. In order to grow car brands need to go outside Tier1/Tier 2 cities. Meidong has had this strategy from day 1.

Meidong looks for smaller cities with less competition to implement its "Single City Single Store" concept. The strategy of management is to pick cities with at least 10,000 new car registrations/year. According to management there are 661 such cities in China. In essence it tries to be the only reputable dealer of a certain brand in a smaller city so all customers in the immediate vicinity buy cars with them and most importantly have them serviced as well. The strategy has helped the company achieve the lowest inventory turnover days of the entire sector (31 days on 31/12/16). Sector peers are between 35-44 inventory days.

In some areas of China the company has exclusivity arrangements where other dealers of the same brand cannot open in a certain radius. Exclusivity agreements are more likely to be signed in smaller cities than big Tier 1/Tier 2 cities.

China Meidong prefers smaller cities as the competition is less intense, it requires lower investment and has better return on investment. Most stores are profitable within 1 year and the payback period for the entire investment is between 3-4 years. As of 31/12/16 90% of Meidong stores are profitable.

A few recent examples:

Late 2016 the Meidong store footprint looked as follows

3

In 2017 the group will add the following 7 stores. As you can see the expansion at Meidong is primarily focused on BMW.

The importance of BMW and Porsche continues to grow. Late 2016 BMW/Porsche/Lexus were 54% of overall sales. With the new store openings this should go well over 60-65% in 2017.

2

Currently about 80% of car buyers apply for some sort of car financing. Customers are required to pay 30-50% upfront and pay-off the remaining amount over a 36-month period. The car financing is mostly done by BMW Financial Services, or similar car brand financing arms. In fact, the only car dealer that has license to offer casr financing directly is Zhengtong. Whenever Meidong refers a customer to BMW Financial Services or a Chinese bank it will get a fee of 1-2% of the loan amount.

Management

CEO, Ye Tao, was educated in MIT and later worked for Silicon Valley based Objectiva Software in Beijing. As of 2008 he joined his brother, Ye Fan, who was already active in car distribution.

Given the IT background of Ye Tao he is very data driven and the company is managed along Western standards. All stores have large amounts of data points, foot traffic metrics, daily reports on sales conversion, ... which are reported to management regularly. In the annual report (page 7) it is even referred to specifically:

We continue to focus much effort in human resources, employee satisfaction and training in 2016. We are blessed with a loyal and capable management team and Simple, Direct and Data Driven corporate culture".

Shareholding

At the end of 2016 about 69% of the shares are held by Apex Sail, a vehicle controlled by the Ye Family Trust.

Note: 32% of the shares are pledged to Rays Capital, see announcements in January and March 2015.

Fidelity is another large shareholder with an 8% stake. Given the low free float it is no suprise that the liquidity is low (ADTV: 257.000 USD).

It can't be excluded that the brothers would do a placement to create some liquidity in the future although it would be surprising to see them do it at levels below 1.8 HKD (IPO price). Importantly all options ever granted by the company were also done at 1.8 HKD/share. Overall annual compensation to Chairman, CEO and CFO combined is slightly over 1M USD so this does not seem unreasonable.

Financials

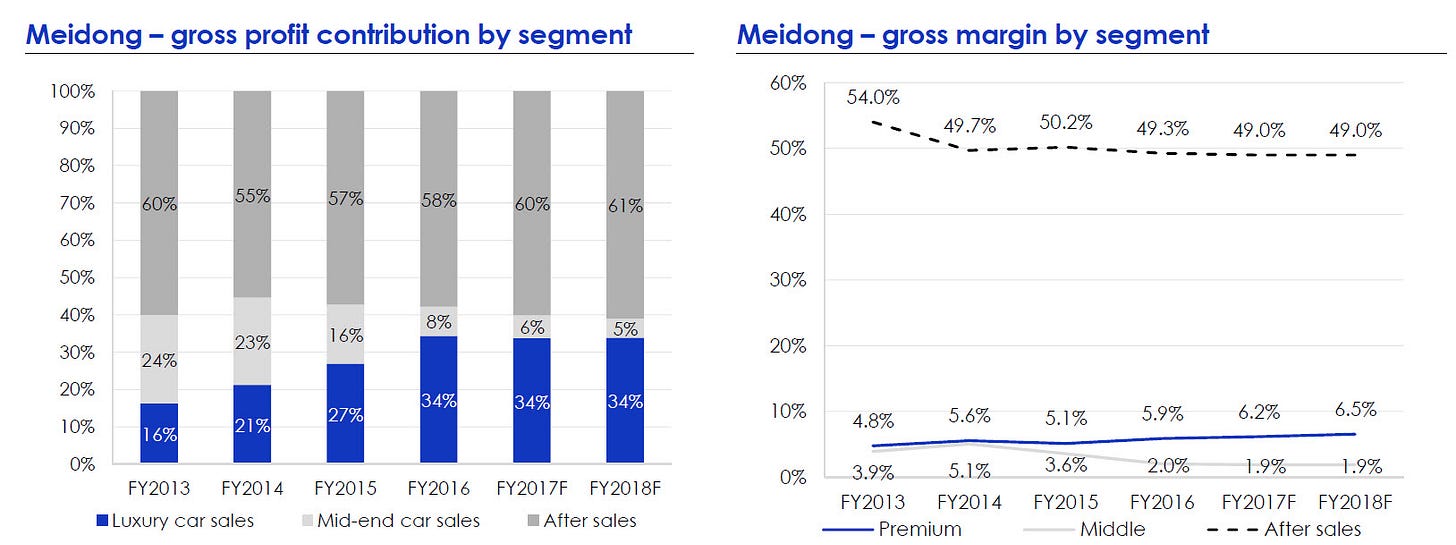

China Meidong has a simple business model and the financials are not hard to understand. The company sells new cars (thin margin) and services them (high margins). The goal of management is to have 90% of all company costs covered by after sales service revenues. As can be seen from the graphs below gross margin on after sales is 49% which contributes significantly to Meidong's results.

2

source: CCB International research 24/03/17

Since the company has gone public in HK its revenues have continued to grow every year. New store openings are projected to result in double digit revenue increases in both 2017 and 2018. My latest interactions with management seem to indicate very strong demand in the first four months of the year. The cherry on the cake should be the launch of the BMW 5 series this summer. BMW 5 series is not cheap (500.000 RMB/car + options) so skeptical investors could question the demand for such an expensive car in lower tier cities in China.

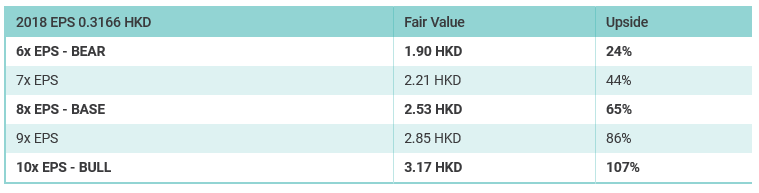

Valuation

Clearly the market is not giving China Meidong much credit. The shares are trading at only 6.75x 2017 earnings estimates and about 4.8x 2018. The dividend yield meanwhile pays you to wait (5.8% yield in 2017 and almost 8.5% yield in 2018). Meidong has the highest payout ratio (46%) versus peers at around 30%. The average dividend yield of the peer group is 2.3%.

On average the peers listed above are trading at 9.2x 2017 EPS and 8x 2018 EPS.

China Meidong should be among the top-3 fastest growers in the sector and, arguably, could trade at least on-par with its sector peers going into 2018.

Investors can choose the multiple they feel comfortable with and the upside is as follows

Bear, Base and Bull case

As the group continues to add stores its earnings should continue to grow. The percentage of more expensive cars (BMW/Porsche) should help to lift the margins as well.

Scott Laprise/ 乐天虎 and other SmartKarma auto experts might be right to see a slowdown in Chinese car demand. In our bear case we assume the group would still meet its earnings projections but would see virtually no multiple expansion. Under these assumptions upside would still be 24%.

Downside should be further protected by the appeal of China Meidong to larger sector peers. If the market does not award the group with a higher multiple the founders might be tempted to sell out to the highest bidder. Meidong might be an attractive target to a larger group considering its Tier 3/4 footprint.

Assuming the company will get a boon from the BMW 5 launch, as management predicts, the group should report strong 2017 results. I would therefore argue that in my base case investors will probably award the company with an 8x multiple (in-line with peers) going into 2018. This gives 65% upside.

If animal spirits are unleashed and Meidong attracts greater investor attention it could trade at a small premium to the sector given its strong growth. BMW 5 volumes might suprise to the upside as well. In my bull case scenario investors would award a 10x multiple and the stock would double.

Risks

Slowdown in car sales in China would hurt all industry peers

Lower tax incentives for car purchases and/or license plate restrictions in lower tier cities

Higher luxury tax on high-end cars would hurt Meidong particularly bad given their focus on Porsche and BMW

BMW 5 series launch might be a failure as customers do not like the design and inventories pile up at dealerships

Did you find this insight interesting? Want to read more investment ideas like this?